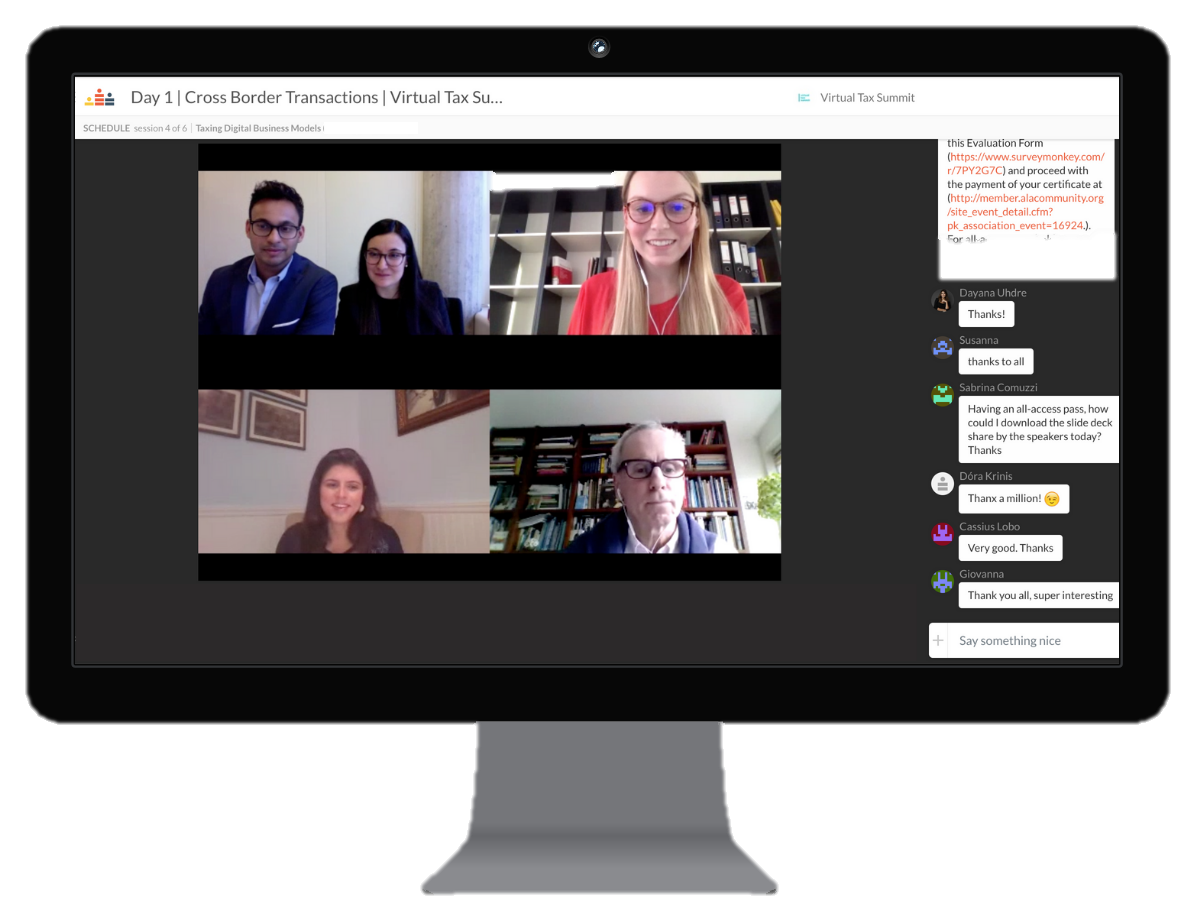

Our events provide an excellent opportunity to learn more about all things tax!

We structure sessions into easy-to-follow, micro-learnings that provide up-to-date, accessible and affordable tax training 24/7.

Our growing database of 40+ hours of tax learning covers everything from transfer pricing, international tax, digital taxation and much more!